It is the debtor that is ruined by hard times. – Rutherford B. Hayes

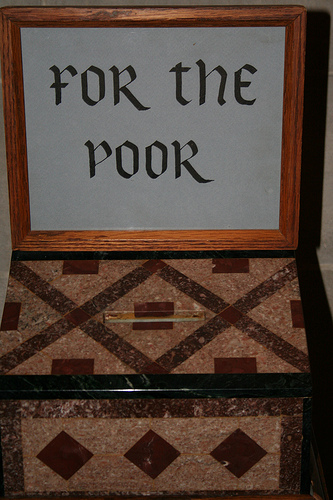

This is both sides of the coin. Stay out of debt, and have money to give. If you don’t stay out of debt, you may find yourself in need of some assistance.

What does that mean?

This is another Twitter-friendly quote which has been shortened from the original: “Let every man, every corporation, and especially let every village, town, and city, every county and State, get out of debt and keep out of debt. It is the debtor that is ruined by hard times.”

In the present world economy, this quote is as appropriate as ever. The first sentence enumerates who should be taking action to avoid or eliminate debt and remain debt free. The sort version is: every person and every fiscal entity, be it business or government. It’s hard for me to argue with that.

The second sentence in the longer quote explains why being debt free is important. Hard times are typically when one has the least cash on hand, and the weakest cash flow. This is when one has the least possibility to take advantage of cheap materials and other opportunities. And there is always the shadow of your debt looming over you as well.

Why is fiscal solvency important?

The adjective ‘solvent’ is defined at TheFreeDictionary.com as meaning “Capable of meeting financial obligations.” If one is insolvent, it means you can’t meet your obligations. Crossing that line from solvent to insolvent is the last step before bankruptcy.

When you’re insolvent, it’s like you’re trapped, and being trapped in a fiscal sense is no more pleasant than being physically trapped, and the outlook can look just as bleak. Trust me, I’ve been there once before, and will not go there again. Let’s just say the experience scared me solvent!

When you are solvent, you can do the extras, give more money to charities outside your usual core (or donate more to your favorite ones), buy the first round, or otherwise be generous to others. You can also get some of the things nicer things you’ve wanted, but weren’t necessities.

Given those descriptions, which would you rather be, solvent or insolvent? I know which path I have chosen, how about you?

Where can I apply this in my life?

Who do you owe, and how much do you owe them? If you can’t answer that question instantly, you might want to go over your financial records. Right now. I won’t tell you how to do it, as there are entire shelves in book stores and libraries devoted to the topic.

So what can we consider? I would like to share some techniques that have helped me. You will have to decide how they fit into your lifestyle and your plans. You will also have to decide if it fits within your budget and abilities. You will have to know what you are capable of doing, right?

The first thing to consider is where are all the bills? Gather them up and add them up. Compare the total to your last check, and see how much extra you have, and estimate how much of that you spend as cash purchases To be a little more formal, you might want to make a spreadsheet, with months going one way, and the litany of bills going the other way.

Now consider how much money you have in savings. What would you do if the pickup truck in front of your car spills a box of nails and you have to replace all four tires? This is an emergency fund, like if the washing machine or refrigerator requires replacement, or you have a medical emergency. This is the emergency fund.

Then there are specific savings, that is savings you accumulate for a specific purpose. This might be for going on vacation, buying a new stereo (for the home or the car), or perhaps something nice to wear or accessorize. While you could raid these accounts in an emergency, they are earmarked for specific purposes, so don’t raid your emergency fund for anything other than an emergency.

If your cash-flow (your check is smaller than your bills), you need to do something, and sooner is better than later. What can you cut back on, or stop doing entirely? Do you really need every station that exists on your TV, or can you save some money and cut back a bit? What about eating out, can you brown-bag your lunch or cook a meal to save some cash? Can you smoke a pack or two fewer each week? Each little thing adds up.

Impulsiveness is a real problem when you’re in a tight financial situation. What can you do to make it harder to buy things? I put my credit cards inside an envelope inside my wallet, and wrote “IS THIS AN EMERGENCY?” on the outside. It helped, but didn’t cure, my impulses. It’s not easy to say no, is it? But you have to try, right?

And we haven’t even gotten to what order to pay off your debts, and how to best consolidate them. I have some ideas, but that’s the kind of advice best left to professionals. And there are plenty of sites on the internet which can offer much better advice, hints, and tips than can I.

If you’re happily keeping your head above water, congratulations. Feel free to share a tip, idea, or whatever with the rest of us. Thanks in advance! 8)

From: Twitter, @UKMotivation

confirmed at : http://www.brainyquote.com/quotes/quotes/r/rutherford393951.html

Photo by rachaelvoorhees

Happy Birthday to Rutherford B. Hayes, born 4 October, 1822